estate tax changes effective date

For the average real estate investor who uses C-corps to earn flip or property management. For the 995 Act.

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

The expected effective date for any changes to tax rates or to estate and gift tax exemption amounts is expected to be January 1 2022.

. The Treasury Budget suggests this tax could be used as a credit against the estate tax. 26 states have notable 2021 state tax changes including 2021 state income tax changes 2021 state property tax changes and 2021 state sales tax changes. For 2022 the Staff of the Joint.

Estate Tax Inclusion effective date. Increased Income Tax Rates for Estates and Trusts effective as of January 1 2022. The Green Book proposals effective dates Treasury revenue estimates and implementation of these policies change during the regulatory and legislative processes.

The proposed effective date of the Treasury proposal is for estates where the decedent dies after December 31 2021. Addressed in the plan are numerous tax law changes but this alert will specifically address the provisions that directly impact estate tax planning Effective date. The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021.

EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It. For example prior proposed changes related estate and gift taxes grantor trusts or passive asset valuation discounts could get added back in if additional revenue is needed. But certainly the drumbeat of change in.

Estate Tax Changes. The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as. Another key proposed change to tax law is to increase the estate tax to 45 from 40 and to repeal the ability for the beneficiary of an estate to receive the step-up in basis at the time of the grantors death.

QBI IRC section 199A changes. The effective date of these tax rates and the tax bracket is January 1 2022. While any proposed changes to tax and estate law probably wont pass.

Until the President signs the bill into law. The effective date for these corporate tax. If Congress were to enact a law with an effective date on or before Dec.

It will take further study to truly determine the likely implications of these changes. 31 2021 that reduced the exclusion from 117 million to say 35 million See. This summary is presented as general information for clients and others and is not intended to constitute legal advice.

Taxable estates and transferors of taxable gifts currently pay tax at a flat 40 percent rate. Pending legislation would accelerate this reduction likely effective on January 1 2022. Decedents dying and gifts made after December 31 2021.

The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. Estate and gift tax rate increases. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

It includes federal estate tax rate increases to 45 for estates over 35 million with further. The ramifications seem significant. Under current law this.

Some significant state tax changes were made in 2020 that do not technically have effective dates of January 1 2021 but are nevertheless worth being aware of at the beginning of a new. Imposition of capital gains tax on appreciated assets transferred during life or at death. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax.

Surcharge on High-Income Individuals Trusts and Estates. How do I protect my assets from estate tax. Another proposed change to the tax rates that we have been expecting is with respect to C corporations.

The House Ways and Means Committee proposes to replace the flat 21 percent corporate income tax rate with graduated rates of 18 percent on the first 400000 of income 21 percent on income of up to 5 million and 265 percent on income thereafter. Effective date for proposed tax changes. January 1 2022 EstateGift Tax Exemption Cut in Half.

January 1 2022 Note. The amount by value of assets excluded from federal estate and gift tax technically the unified credit would revert to its level in 2010 of 5 million per individual indexed for inflation. Reduction in Federal Estate and Gift Tax Exemption Amounts.

Trusts created on or after the date of enactment or to any portion of a trust that was created. Although the proposal indicates that the highest C-corp tax rate can increase from 21 to 265 it only impacts C-corps with income above 5 million. These graduated rates phase out for corporations with taxable income in excess of 10 million.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. The following summarizes some of the proposed estate and gift tax changes. If the trust later sells the property for 110000 the trust can offset the gain with the 30000 previously disallowed loss and only pay tax on.

Right now with both parties at an impasse the administrations proposed legislation seems to change daily. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million. Summary of Proposed Federal Estate and Gift Tax Changes.

Under provisions of North Carolinas biennial budget bill signed by Governor Roy Cooper D on November 18 2021 the states flat income tax rate was reduced to 499 percent on January 1 2022. The proposed effective date of the Treasury proposal is for estates where the decedent dies after December 31 2021. The unified estate and gift tax exemption is currently 117 million and is already scheduled to drop in 2026 to around 6 million.

38 This is the first of six incremental reductions that will ultimately reduce the rate to 399 percent by tax year 2027. Estate and Gift Tax Exemption Reduction Using the Excess Exemption Before Its Lost. Taxable years beginning after December 31 2021.

The change would be effective as of the date of enactment. Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. Certain provisions may be effective as early as October.

The bill would convert this flat rate structure to a.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Best Expired Listing Letter S For 2014 Real Estate Agent Branding Real Estate Marketing Plan Real Estate Marketing Strategy

Bookkeeping Letter Of Engagement Template Intended For Bookkeeping Letter Of Engagement Template In 2022 Engagement Letter Letter Templates Lettering

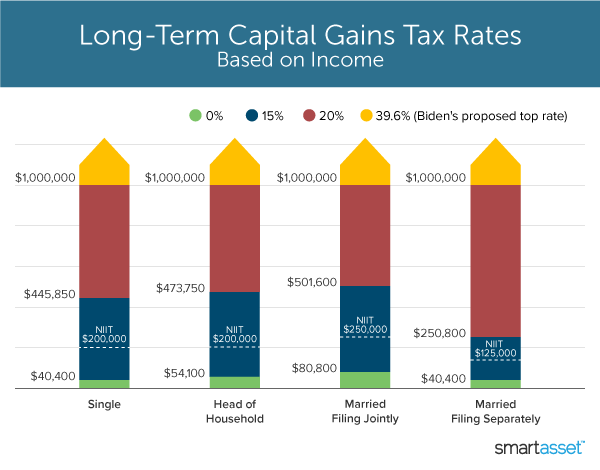

What S In Biden S Capital Gains Tax Plan Smartasset

Secured Property Taxes Treasurer Tax Collector

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

City Of Reno Property Tax City Of Reno

2022 California Property Tax Rules To Know

Final Project Budget Report Budget Report Template Budget Report Template Should Be Chosen Well And Shoul Budgeting Budget Planner Template Report Template

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Secured Property Taxes Treasurer Tax Collector

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Where Not To Die In 2022 The Greediest Death Tax States

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan Business Plan Template Free Irs

Fill In Your Tax Returns Four Times Every Year Tax Return Being A Landlord Tax

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)